As per CGST Act 2017, There are lot of the type of the GST Returns which you have to file on the monthly basis and also require to file one annual return. if you are registered under the GST Composition Scheme then you have to file the returns quarterly basis with annual return. Most of the times you have to file the GSTR 1, GSTR 2 and GSTR 3 Return. GSTR 1 Offline utility in Excel format is available for download… As per CGST law, a normal taxpayer will be required to furnish three returns monthly WITH one annual return. Taxpayer registered as an Input Service Distributor, a person liable to deduct or collect the tax (TDS/TCS). Get more details for How to File GST Return online, Every registered taxable person has to furnish outward supply details in Form GSTR-1 by the 10th of the subsequent month. . here you may download GST Return Formats in Excel and PDF Format, This document lists out the salient aspects of the process related to filing of Returns under GST.

GST Return Filing Online with GSTN

The implementation of GST return in India is the biggest tax reform the country has ever witnessed. As per the GST law, there are over 10 types of GST returns that are to be filled by various kinds of users for different purposes. However, the digitalization of GST portal makes it easier to file any of such return by following these steps:

The foremost step is to make sure that you have successfully registered with GST and have obtained the 15 digit GST identification number.Now, the next step is to visit the GST portal.Log in to your account using your username, password, and the captcha shown.After entering into your account, click on ‘Return Dashboard’.In the next screen, you can see all the forms that you need to file as per your registration and business type.Click the Form for which you want to file the return.In the next screen, you can upload all the relevant invoices.In the next step, you will be required to enter details of debit and credit notes as per the form you are filling.After all the required details are entered, file your return by clicking on ‘Submit’.

How to File GST Return Online?

Each manufacturer, dealer, supplier, and consumer who has registered under GST have to file GST returns each year. In the new tax system, return filing has been automated completely. Thus, you can file GST returns online through the app or software of Goods and Service Tax Network. Below are the steps you can take to file a GST return online:

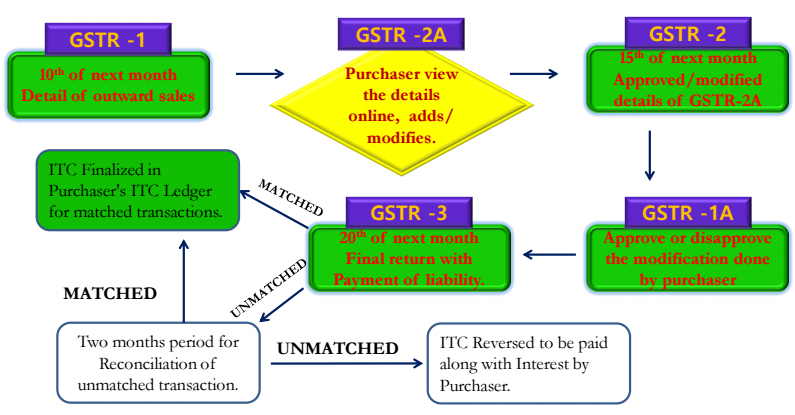

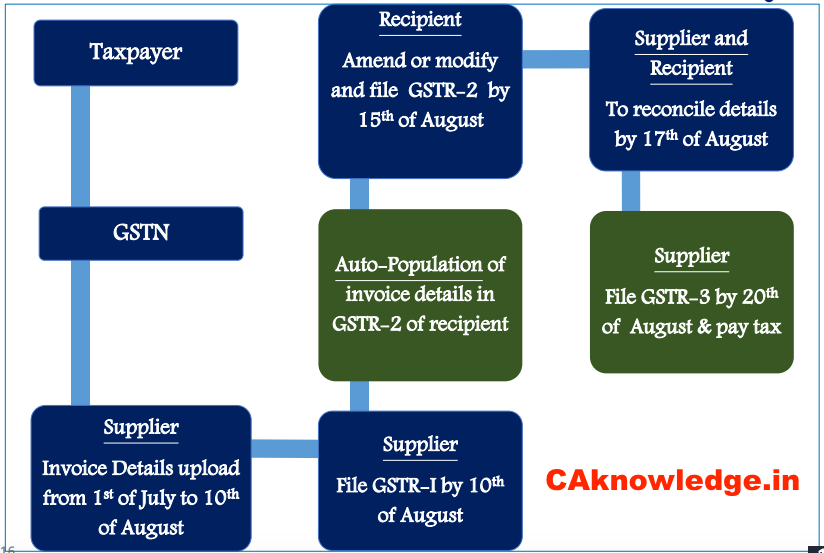

First of all, visit the GST portal and log in to your account using the 15 digit GST Identification Number allotted to you based on the state code and PAN.Next, upload your invoices on the GST portal. Each invoice you upload will be allotted an invoice reference number.The next step after uploading the invoices is to file the outward return, inward return, along with monthly return.The outward supply return will be filled in GSTR-1, which is available in the information section on GST Common Portal by the 10th of each month.The outward return for the supplies is done through GSTR 2A.Follow this step by verifying and modify the outward supply details along with credit and debit notes.The inward supplies details of the taxable goods and services need to be furnished in GSTR-2 Form.The recipient of GSTR-1A has the option to modify the details furnished on the outward and inward supplies later. However, the supplier has the power to either accept or reject the modifications made.

Please Download GST Return Offline Utility in Excel format from below link…. Click here to Download all GST Online Return Formats in Excel & PDF Format

Download GSTR 1 Excel Utility File by gst.gov.in

What Are the Types of Returns Applicable Under GST Regime?

All the returns under the Goods & Services Tax regime are required to be filed electronically through GST Network portal. Chapter IX of the Central GST Act, 2017, read with CGST Rules, 2017 contains the provisions of returns to be filed by various taxable persons. Following is a summarised list of these returns: GST Return Formats or GST Return Forms – In the table below, we have provided details of all the returns which are required to be filed under the GST Law.

Late fees for delay in filing GST return

Delay in filing any of the following by their respective due dates, attracts late fee:

(A) Statement of Outward Supplies Section 37 Returns Section 39 Final Return [Section 45]

The late fee can be waived off partially or fully by the Central Government [Section 128]. Section 128 has been discussed in detail in Chapter 21: Offences and Penalties in Module 3 of this Study Material.

GST Return Forms in Excel Format

Download GSTR 1 Excel Utility File by gst.gov.inForm GSTR 3B (In PDF)Form GSTR 3B (In Excel)

GST Return Process, E-Filing of GST Returns

How to File GSTR 1, GST Online Return Filing Process at GST PortalHow to File GSTR 2, GST Online Return Filing Process at GST PortalHow to File GSTR 3, GST Monthly Return Filing Process at GST Portal

GSTR-3 form will be filled automatically on the basis of outward supplies and inward supplies with the payment of tax furnished in GSTR-1 and 2. The form will be prepared by 20th of the next month. Based on the category of registered person such as monthly return is to be filed by Regular, Foreign Non-Residents, ISD and Casual Tax Payers whereas Compounding/Composite tax payers has to file quarterly returns:

GST Returns Others

- Every registered person who is required to get his accounts audited shall furnish, electronically, the annual return (FORM GSTR- 9) along with a copy of the audited annual accounts and a reconciliation statement, reconciling the value of supplies declared in the return furnished for the financial year with the audited annual financial statement.

- Registered person who is required to furnish a return as above and whose registration has been cancelled shall furnish a FINAL RETURN within three months of the date of cancellation or date of order of cancellation, whichever is later, in FORM GSTR-10.

- Every person, who has been issued a UIN(Unique Identity Number) and claims refund of the taxes paid on his inward supplies, shall furnish the details of such supplies of taxable goods or services or both in FORM GSTR-11 along with application for such refund claim.

Returns Under GST, Returns Under Goods and Service Tax

Who needs to file GST Return?

Every registered dealer is required to file return for the prescribed tax period. A Return needs to be filed even if there is no business activity (i.e. Nil Return) during the said tax period of return;Government entities / PSUs , etc. not dealing in GST supplies or persons exclusively dealing in exempted / Nil rated / non –GST goods or services would neither be required to obtain registration nor required to file returns under the GST law.However, State tax authorities may assign Departmental ID to such government departments / PSUs / other persons and will ask the suppliers to quote this ID in the supply invoices for all inter-State purchases being made to them.

Download GSTR 1 Excel Utility File by gst.gov.inGST Definition, Objective, Framework, Action Plan & ScopeGST Registration – Procedure, Rules, Forms, Documents RequiredGST Registration Formats, Download GST Registration Forms

Salient Features of GST Returns

Filing of returns would only be through online mode. Facility of offline generation and preparation of returns will also be available. The returns prepared in the offline mode will have to be uploaded.There will be a common e-return for CGST, SGST, IGST and Additional Tax.A registered Tax Payer shall file GST Return at GST Common Portal either by himself or through his authorised representative;There would be no revision of Returns. Changes to be done in subsequent Returns

Download GST Practitioner Formats

GST Monthly Return Rules 2017

Every registered person, other than a person referred to in section 14 of the Integrated Goods and Services Tax Act, 2017 or an Input Service Distributor or a non-resident taxable person or a person paying tax under section 10 or section 51 or, as the case may be, under section 52 shall furnish a return specified under sub-section (1) of section 39 in FORM GSTR-3 electronically through the Common Portal either directly or through a Facilitation Centre notified by the Commissioner. Click Here to Read all GST Rules 2017 (Final)

GST Annual Return

(1) Every registered person, other than an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person, shall furnish an annual return as specified under sub-section (1) of section 44 electronically in FORM GSTR-9 through the Common Portal either directly or through a Facilitation Centre notified by the Commissioner: Click Here to Read all GST Rules 2017 (Final)

GST Final Return

Every registered person required to furnish a final return under section 45, shall furnish such return electronically in FORM GSTR-10 through the Common Portal either directly or through a Facilitation Centre notified by the Commissioner. Click Here to Read all GST Rules 2017 (Final)

GST ScopeGST Current Tax Structure and proposed GST RegimeFiling of GST Online ReturnImpact of GST in Indian EconomyTax Structure of GSTPresent Tax Structure and GST StructureWhen will GST be applicableWhy GST For IndiaGST Online Return Rules

If you have any query or suggestion regarding “GST Return, Returns Under Goods and Service Tax” then please tell us via below comment box….